Money may be a soremeter for some people – it can come up with emotional goods, trigger feelings of anger, fear and insecurity. This can also happen when money is lent to a loved one, especially if the money is not repaid.

To learn more about borrowing and lending to loved ones, Lendingtri surveyed over 2,000 American inhabitants. The results showed that money was given by a friend or family member of a third of the respondents, resulting in many reporting regrets and stress – or even the full end of the relationship.

major findings

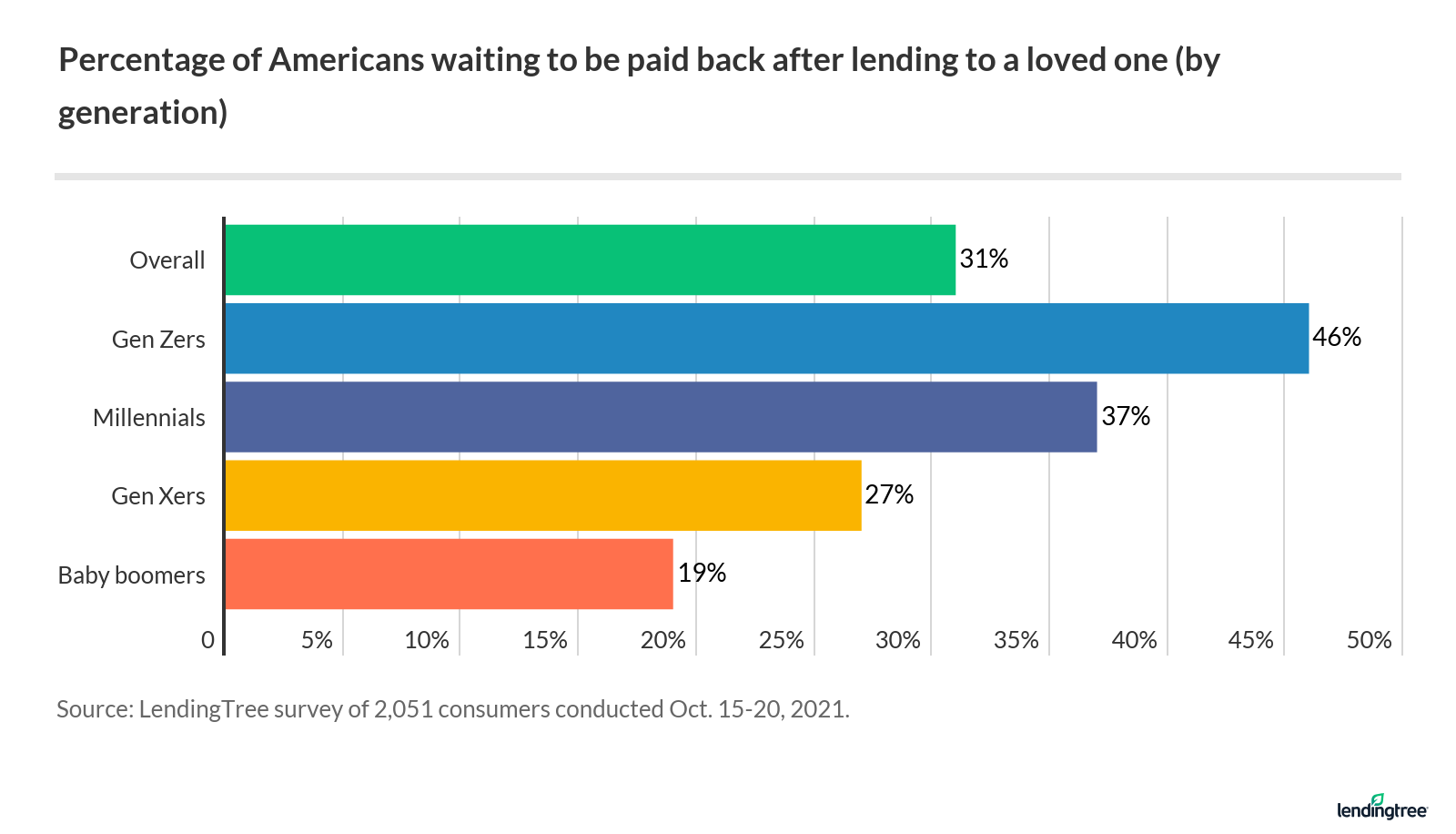

- 31% Americans say that a loved one has given them moneyWith an average amount of $ 400. Friends and brothers and sisters were most likely to be the debtor, and Jean Zars was more likely to have money than any other age group. (Read more)

- Was a loved one Borrow borrowing money to pay loan is most likelyAfter covering food and gas expenses. (Read more)

- Nearly half the money dues by a loved one Repeated, And 1 out of 6 says that there was money Ruined a relationship(Read more)

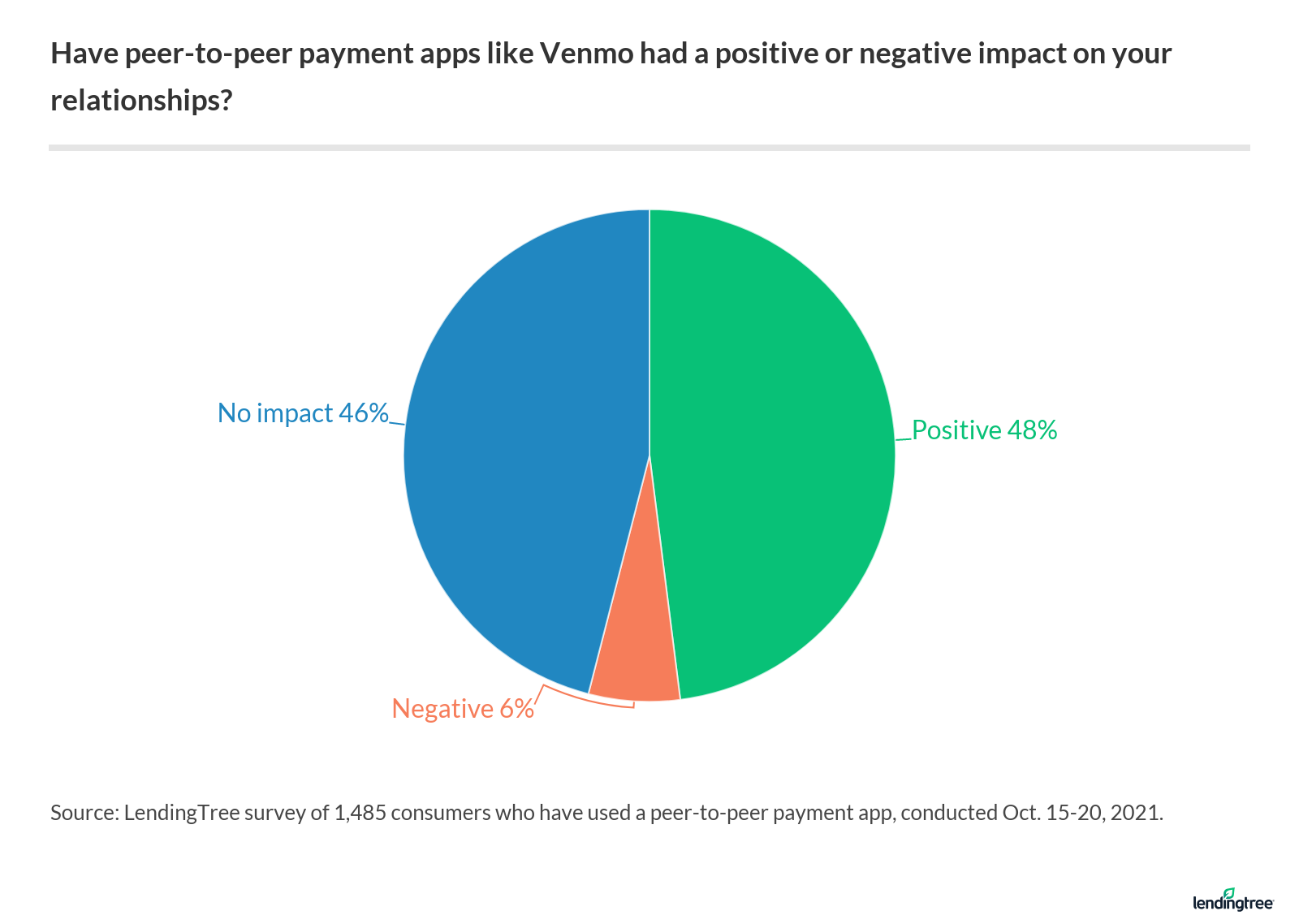

- On the other hand, about 60% of the millennium and General Zars say that Payment apps like Venmo have positively affected their relationships By reducing strangeness around asking loved ones for money. (Read more)

Which Americans are outstanding money by their loved ones?

About 1 out of 3 of the people surveyed by the lending (31%) reported that a loved one was in debt for them. Within the group of lenders who gave money to a friend (49%) or brother -in -law (26%), with the most common, with full list:

- Friend (49%)

- Sibling (26%)

- Romantic relationship (20%)

- Extended Family (19%)

- Parents (18%)

- Baby (16%)

In the context of generational differences, Lending found that General Jars was paid more money than any other age group, with 46% lending to others, followed by millennium at 37%.

According to Landingter’s chief credit analyst Matt Shulz, a possible reason for this is that the General Z Credit is new: “It makes it difficult for them to get a traditional loan, which, in turn, may be more likely to borrow from friends.”

“Another reason is that they are even more comfortable with technology than other generations,” says Shulz. “They are using Venmo until they have no money to spend, so they can simply feel more comfortable lending because it is so easy.”

In terms of gender, 36% of women say that money was outstanding, vs 25% male.

Meanwhile, people who earned less than $ 35,000 per year were more likely to have money by a loved one than people with high income.

And how much was these people outstanding? The average amount was just $ 400, but the average was very high at $ 8,170. This was because the data was slanting by several large amounts, possibly for the payment of the house or similarly for large -scale expenses.

Top reasons people give money to friends and family

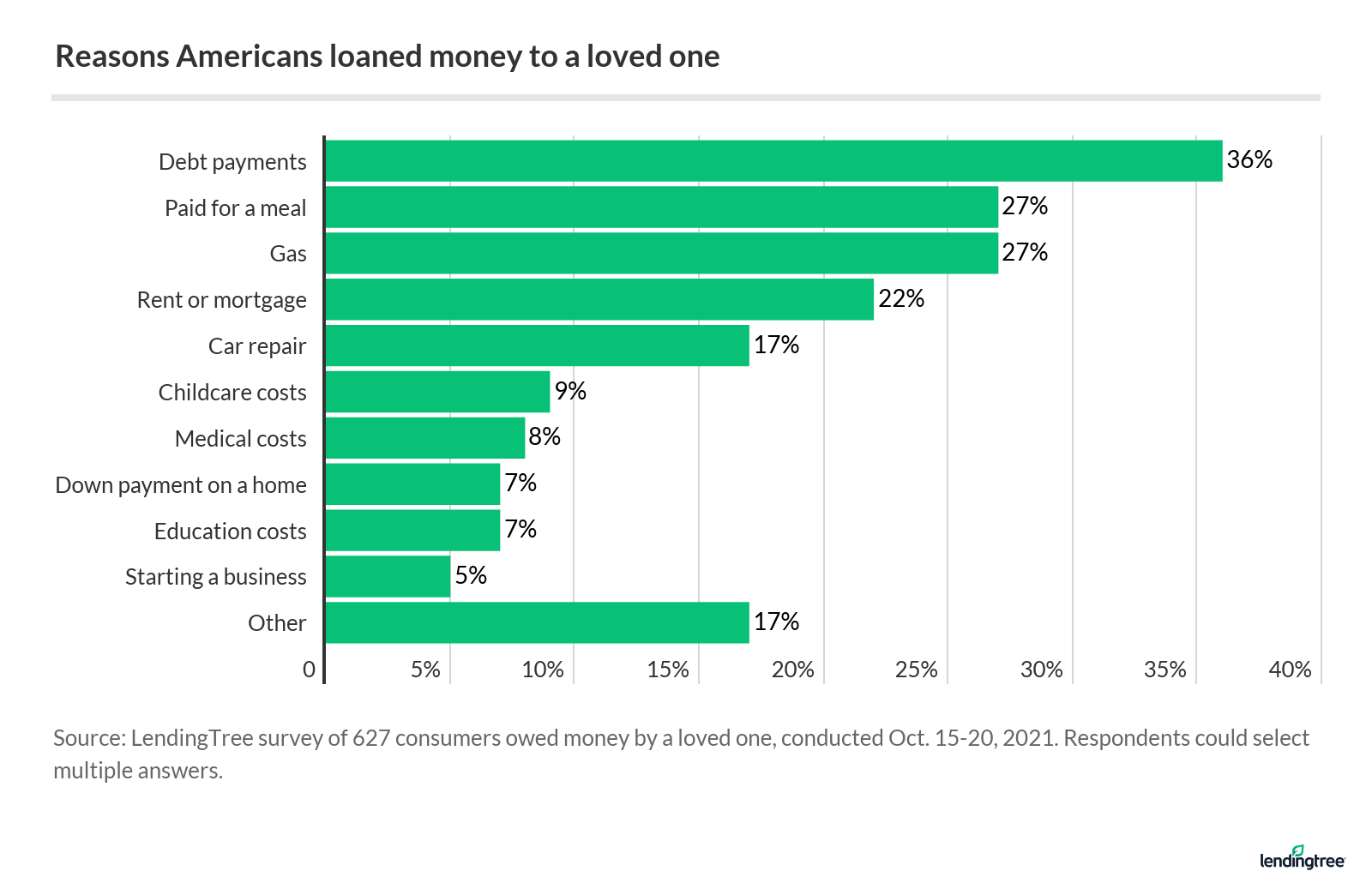

No. 1 reason respondents gave money to friends and family, helping the person to help pay loan (36%). This can be for a variety of credit such as personal loans, auto loans or credit cards.

Unpaid lenders can damage the credit of a borrower and even if the loan is secured and default by default, the property seized in the property can also result in results. This can explain why loan payment tops the list of reasons for giving money to a relative or friend in our survey list.

The basic needs of a loved one such as food and gas (27% each), as well as paying for rent or hostage (22%), were the next reasons to ask for a loan for a loved one.

Meanwhile, unexpected costs such as car repair represented 17% loans for family and friends, while medical costs represented 8% of loans.

How to borrow from friends and family can ruin relationships

Unfortunately, money to loved ones (or not borrowing) money can lead to challenges in the relationship.

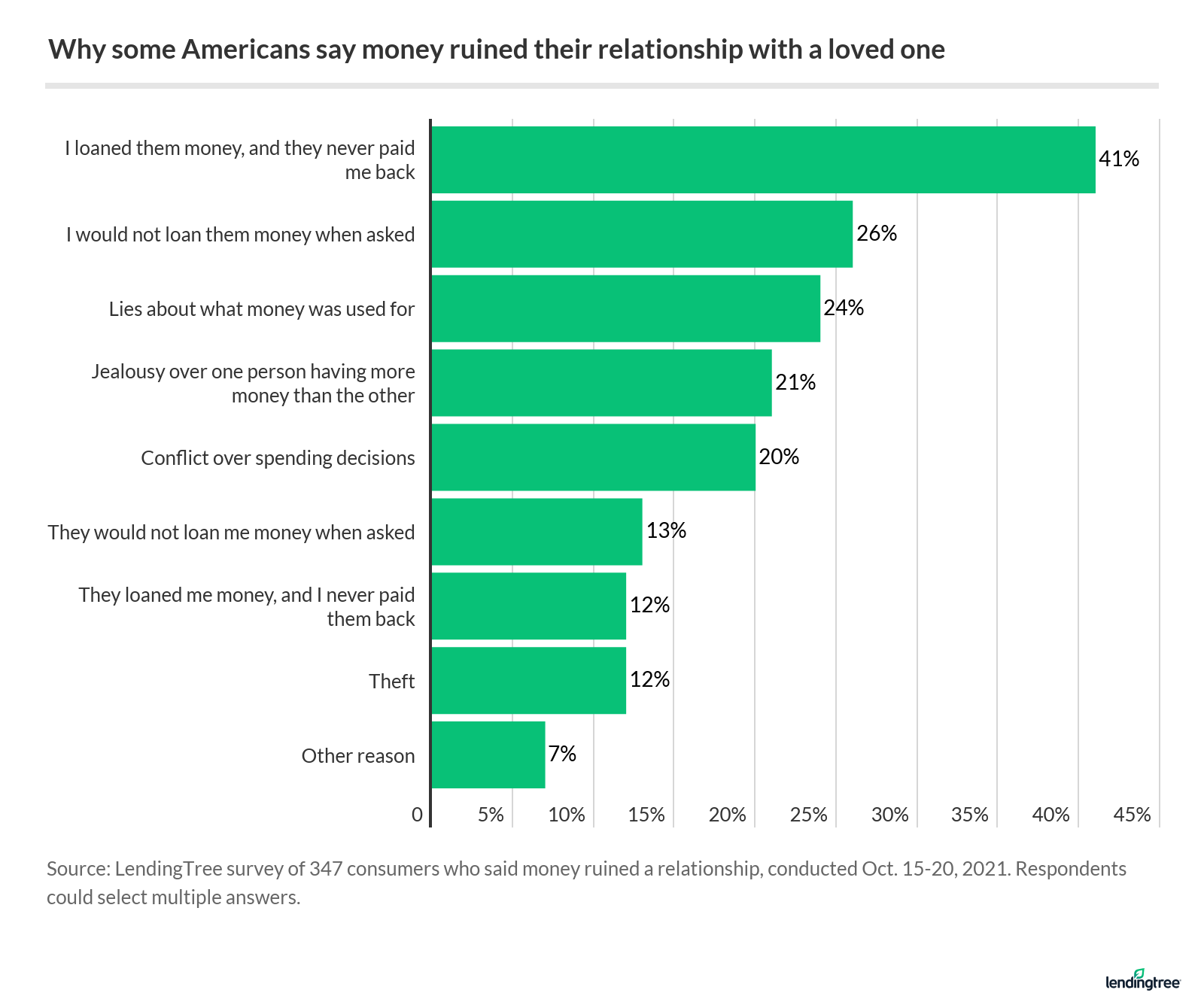

Consider that 1 out of 6 survey respondents say that money has ruined one of their relationships, and that the loan is not being repaid the top reason (at 41%).

Another 27% says that while the relationship was not ruined, the money became the cause of stress.

“Nobody cares about your money as much as you do, so you need to protect it,” says Shulz of Lendingtri.

He says, “Sometimes it means uncomfortable interaction with loved ones. As the conversation may occur, nervous-veracking can happen, it will nothing that can happen like things because things are already away from rail,” they say.

A relationship ended for other reasons for the money: 26% says it was because they refused to lend money, while 24% said that they lied about how the money was used.

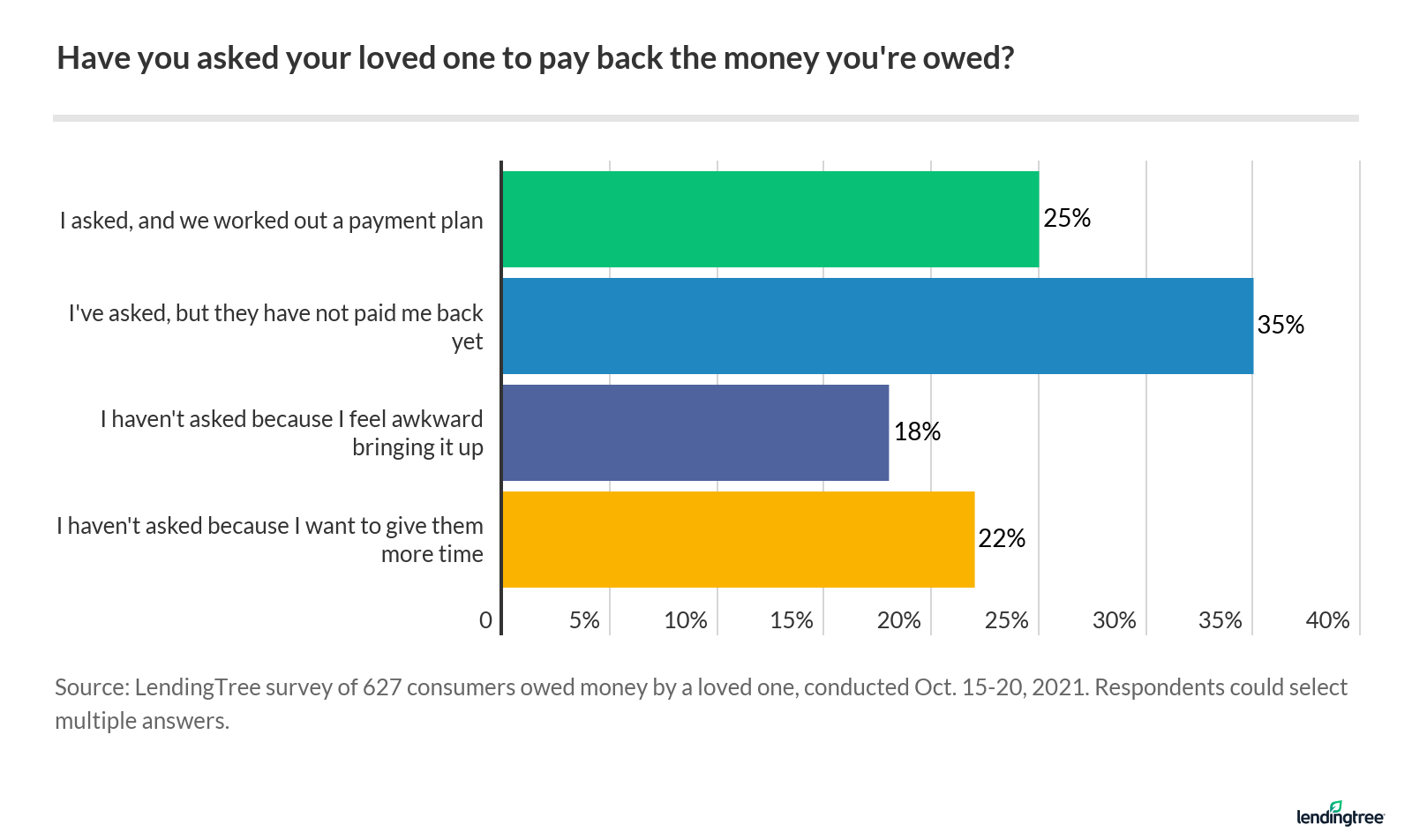

Perhaps as a result, about half (46%) of those who gave money to a loved one say they now regret it. This can happen because 60% of the people paying for the loan have so far asked to see that money.

The most affected sections of those whose relationships were ruined were millennium (22%), women (20%) and less than $ 35,000 (22%).

How technology is reducing stress around borrowing from loved ones

On more positive note, technology is making it very easy to repay friends and family.

According to our Lending Survey, about 60% millennium and general Z users say that finance apps like Venmo have brought more ease in their relationships. , By reducing strangeness, which can ask loved ones to pay back. If you include all generations, 48% gave positive results using a colleague to the colleague payment app.

Why the reason?

“This is very less strange to request money through Venmo, as it is to do it on the phone or through email or especially in the person,” Shulz says. Nevertheless, he notes, “It is not necessarily easy to collect that money in all examples.”

He says, “Ultimately, a person can only ignore a request. However, the possibility of being ignored or rejected seems to be very painful and very little individual through Venomo, when you are face to face with someone,” they say.

In fact, 61% of colleague to colleague payment app users say that their friends or family usually paid them back immediately after the payment request, although the remaining 39% still had to remind them.

Tips to lend money to friends and family

To avoid conflict around money, there are many approaches you can take. These steps can help keep your communication clear and consistent, keeping your expectations in front.

- Create a contract: Rolling a legally binding contract may seem intimidating, but if you are considering lending to a loved one it can give you peace of mind. Be sure to underline the terms of the loan, such as the amount, payment payable dates, any interest or fee are being charged and when the money should be paid.

- Install a payment plan: If you decide not to use a contract, you still want to set up a payment plan with the person you are lending. Underline each payment period and how much payment should be made on each due date. When you expect the loan to be paid completely, be sure to specify it too.

- Lend only the money you can tolerate: If you are considering lending money to a loved one, do not pay more money than you can give to lose. Although it can be good to have expectations around repayment, there is always an opportunity that you can never see that money again. On the other hand, friends and those asking for money from family should only ask what they need (and what they can repay).

Procedure

Lendingtree commissioned Qualtrics to conduct an online survey of 2,051 US consumers from 15 October to 20 October 2021. The survey was administered using a non-non-use-based-based sample, and the quota was used to ensure that the sample base was represented by the overall population. All reactions were reviewed by researchers for quality control.

We defined generations as the following age in 2021:

- Generation Z: 18 to 24

- Millennial: 25 to 40

- Generation X: 41 to 55

- Baby Boomer: 56 to 75

While the survey also included consumers of the silent generation (76 and older), the sample size was very small, including the conclusions related to that group were included in the generational breakdown.