Buy less and sell high. It sounds easy, isn’t it? The problem is telling what is really “less”.

How do you define whether the stock market is cheaper or expensive?

perfect The market evaluation is exceptionally difficult. This involves guessing many major beliefs Interest rates Or increase in income per share.

agree Kiplinger’s personal finance

Become a clever, better informed investor.

Save up to 74%

Sign up for Kipperinger’s free e-use

Benefits and rich with expert advice on investment, taxes, retirement, personal finance and more – directly for your e -male.

Benefits and rich with specialist advice – directly for your e -melody.

So the investors-even the great-“quick and dirty” of the time like Warren Buffett come back to the metrics.

These matrix are designed to tell you whether the market is generally cheaper or generally expensive. But they do not intend to use with surgical precision.

It happens that “Oracle of Omaha” has its own quick-and-divert metric, “Buffett indicator”. The buffet indicator is a wide measuring rod whether the stock market is overwelled or underwellude relative to the size of the overall economy.

Buffett referred to this indicator as “perhaps the best single measurement where the evaluation stands at any moment”.

It is not a device for short -term trading.

But this can be a truly solid tool for long -term allocation decisions, such as 401 (K) plan or even in institutional portfolio such as pension scheme.

What is a buffet indicator?

The buffet indicator is calculated by dividing the total market capitalization of a publicly traded shares of a country by its GDP (GDP). The market cap is the total value of all the outstanding shares of the company that is trading in public.

For example, Microsoft (MSFT) market cap is $ 2.6 trillion. This is the total value of all Microsoft stocks in the existence. We connect every other listed company to reach the total market cap of a country.

If we were putting a buffet indicator to work in America, We will use the Wilshire 5000 Total Market Index. Wilshire 5000 usually includes more companies than the S&P 500 index or Dow Jones Industrial Average.

We will divide this broad measures of almost all publicly traded American stocks by the US GDP.

In short, the buffet indicator is equal to the total market cap divided by GDP. Its utility is based on the idea that, over time, stock values should roughly move with the economy.

When this ratio is high, it suggests that the market evaluation is leading beyond actual economic production, which means that the market is potentially overwelled. A low ratio may indicate devaluation and possibly a good purchase opportunity.

It is important to note that the number in a vacuum does not mean much. There is no complete level which means the market is cheap or expensive. You have to compare it over time and find trends.

Historically, the buffet indicator is about 75% to 90%. The value above 100% may suggest that the stock market is overwellized, although some argue what the interest rates, profit margin and changes in globalization matters as a “general” ratio.

The Buffet Indicator has certainly been trending higher in the last few decades.

Buffett indicator in action

Let’s take a look at the Buffet Indicator today.

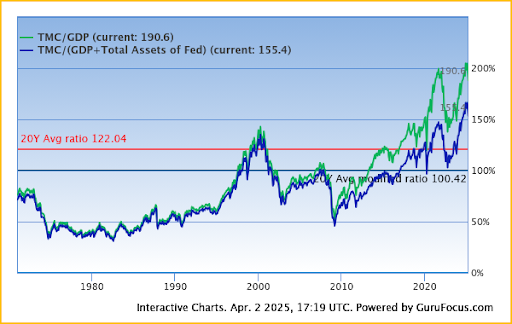

The research site Gurfocus calculated the traditional buffet indicator (Green Line) with a modified buffet indicator (blue line), which attempts to accommodate for the incompatible monetary policy of the Federal Reserve since the 2008 meltdown.

What is here that looks in chart form:

(Image Credit: Sijmore Capital Management)

Some things jump correctly from the chart.

If there is a 100% buffett rule that is the thumb rule for overvival, the market has spent most of the extraordinary expensive fields in the last 20 years. The average has been 122%.

Of course, today we are above that level.

Even after recent stock improvements, the traditional buffet indicator is above 190%. And the fed-adjustable buffet indicator is sitting at 155%.

When Buffett supported this in Forbes, the ratio increased to record high during the dot-com bubble. The indicator fell in the early 2000s after the market accident.

But it has climbed continuously over decades, often reaching its level above its historical average.

Buffett indicators from takeaways

Does the high level of Buffett indicator suggest that a market accident is adjacent? No, and it is not how the indicator is designed to use.

It is exceptionally poor as a short -term time tool. If you had dumped your shares due to overwelling in the index, you would have remembered one of the longest and extreme bull markets in history.

But it is a useful tool to understand where we are in the broad market cycle. You should use it, balanced your portfolio between stock, bonds, cash, gold and other assets.

If you are investing heavy in shares now, you may want to diversify your portfolio by increasing your exposure for other asset classes.

And, similarly, when the indicator takes a dip in the “cheap” area, you can consider increasing your risk for stock.