Semikers are selling as a tariff agenda of Stock Trump, which are increasing the ongoing tension between business partners. Is this an opportunity to buy Taiwan semi?

Generally, stock prices run based on quarterly income or economic indicators such as inflation or unemployment rate. At the moment, those variables have taken a back seat on another huge subject: swallowing the investor’s spirit.

Of course, I am referring to the tariff policies of President Trump. The earning season is coming quickly, investors are definitely going to dial to the earnings, to hear what corporate officials have to say how tariffs are affecting their businesses.

Let us find out how the story around Trump’s tariff has already affected the stock market – and in particular, the technology sector. From there, I will work on a semiconductor stock and if I find out Taiwan semiconductor manufacturing (TSM 1.03%, It seems that the company’s earnings come to mind on 17 April.

Trump’s tariff policies are shaking the stock market, and Big Tech is really feeling pressure

President Trump announced his new tariff agenda on 2 April, called the High-Profile event “Liberation Day”. since, S&P 500 (^GSPC -0.17%, And Nasdac Composite (^Ixic -0.05%, The lowest levels have fallen more than 10%. In addition, the megacap development stock in the technology sector is feeling considerable pressure.

Currently, the attraction of Artificial Intelligence (AI) is not enough to woo careful investors. As the chart shows, Roundhill fantastic seven ETFsWhich tracks the “fantastic seven” stock movements Nvidia, Microsoft, Apple, Tesla, Meta platform, AlphabetAnd HeroicAbout 5% below April 2.

Spx data by ^ycharts

Chip stocks are particularly weak

Although this analysis highlights how Tariff Katha is affecting major technology shares, it does not do much to help us understand how the new policies of Trump are affecting the semiconductor industry.

I am double the reason for being concentrated on semiconductor. First, Chips play an integral role in the development of generative AI. In addition, chip companies such as Nvidia, Advanced micro equipmentAnd many more outsources of their manufacturing for Taiwan semiconductor.

These tariffs have already caused a lot of tension among the International Trade Partners with the US, given that many American technology companies rely on construction services from Taiwan Semi, which are subject to specific items tariffs, dialogue around it can take a toll over the trading possibilities of the near-period.

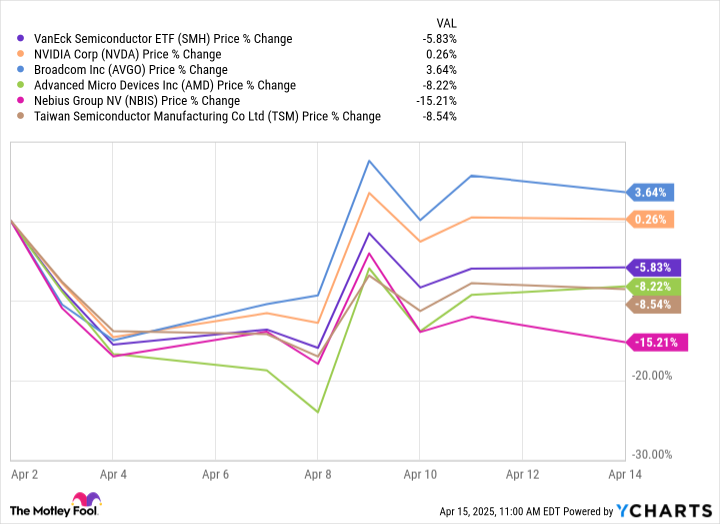

SMH data by ycharts

As the graph indicates, the chip stock has not happened so well in the last few weeks. Of the shares I have underlined, TSMC is the second worst performing stock in this colleague set, with a decline of 8.5% from April 2.

Image Source: Taiwan Semiconductor Manufacturing.

Should you now buy a dip in TSMC stock?

I can understand if there is still a disorientation to the sold-off investors in the stock market. He said, as a long -term investor, there are some things in my mind.

Unlike other forms of law and regulatory cases, tariff policies do not always require mediated approval from the Congress. For this reason, tariffs can usually be applied or reversed very quickly. It can be a positive or negative depending on the dynamic condition.

For example, the Trump administration can opt for a very specific types of tariffs around semiconductor products or certain aspects of some countries, which manufacture and export them in the US, given how fast these policies can change, it is natural for investors to decrease with all uncertainty.

Along with this, it was said, I am watching a silver lining hidden between this Hupala. According to the leadership of the National Economic Council, the Trump administration is currently in talks with 130 countries around the tariff. I am carefully optimistic that this business talks are a good sign for coming under the road.

Another way said, I see tariffs as a bargaining chip to re -organize business relations. For example, the uncertainty of the close-term has created widespread nervousness in the capital markets. However, long -term results can be very positive if America is capable of excluding some new trade deals.

While day-to-day talks and conversations will probably dominate the news headlines, I will not focus too much on it right now. Instead, I encourage investors to focus on the trick of Big Tech.

So far this year, several large -scale AI infrastructure projects have been announced, including more than $ 300 billion from Microsoft, Meta, Amazon and alphabet, as well as a commitment of $ 500 billion from Apple. Investment in AI does not go away, and I see the spending on Big Tech as a catalyst for long -term TSMC services.

While I suspect the market will look at volatility as the tariff position comes out in the near period, I think the current dip in Taiwan Semi Stock is very good to pass now. Therefore, I will encourage investors to consider buying Taiwan Semi shares as a rapid approach to earning season.

Suzanne Frey, an executive in Alphabet, is a member of the Board of Directors of the Motley Flower. Randy Zuckerberg, former director of Market Development and spokesperson for Facebook and sister of Meta Platform CEO Mark Zuckerberg, is a member of the board of directors. John McKay is a member of the Board of Directors of Motley Fool, a former CEO of Hole Foods Market, an Amazon Assistant Company. Adam Spatakco has conditions in alphabet, Amazon, Apple, Meta Platform, Microsoft, NVDia and Tesla. Motley flower recommends advanced micro devices, alphabet, Amazon, Apple, Meta Platform, Microsoft, Nebius Group, NVDia, Taiwan Semacist Manufacturing and Tesla. Motli Fool recommends broadcom and recommends the following options: Long January 2026 $ 395 calls on Microsoft and January 2026 $ 405 calls on Microsoft. The Motley Fool has a disclosure policy.

Dive into the remarkable experience of this incredible product! Crafted with care, it delivers superior performance to elevate your life. Whether you’re working, this standout promises durability that shines. Ideal for everyone, it’s time to treat yourself! Shop now and enjoy the difference today! Grab It Now!

Unlock the power of this top-notch item that redefines your work! Showcasing cutting-edge technology, it’s created to impress with flawless functionality. Perfect for upgrading, this essential complements any lifestyle. Get yours to love its benefits! Shop Today!

Elevate your routine with this unparalleled product that stands out! Meticulously engineered for style, it offers luxury to suit your life. From its sleek features to its versatile appeal, it’s a crowd-pleaser. Click now to make it yours! Buy It Here!

Step up with this outstanding item that’s packed with value! Designed to offer excellence, it’s just right for everyone seeking flair. Its innovative design promises a memorable experience every time. Shop now and love what makes it so awesome! Get Yours Now!

Celebrate the magic of this essential product that enhances your home! Featuring state-of-the-art craftsmanship, it’s built for versatility. Trusted by people for its appeal, this is a must-have you’ll cherish. Click today to experience it! Order Today!