A single space force contract can expand the revenue of the small company about 50% annually.

From April 2 to April 8, S&P 500 The index fell more than 12% in response to President Donald Trump to implement “mutual tariff” on imports from almost every country around the world. Trump temporarily stopped something (but not all) of his new tariff on Wednesday, but again increased by 9.5%, but then on Thursday half of those benefits returned as investors digest more, where the Lump Business War stood up.

The “roller coaster” does not begin to describe the ride that we have now found ourselves. The “Tower of Terror” will be more accurate.

And yet, if you forgive me to change the metaphors, it is during such times that investors should take care not to remember the forest for trees. And forest surrounding forest space company Rocket lab (RKLB 0.05%, Looks very green now.

Rocket Lab’s Big Nutron News

At the end of last month, Tariff News before handling all the headlines, the rocket lab announced that the US Space Force included it in Phase 3, Lane 1 of the National Security Space Launch Program, (NSSL3.1).

What is NSSL3.1? Originally, it is a umbrella contract under which the government assembles all companies that believe that the satellites launched in the next five years and the types of spacecraft will be able to launch. The government has determined the maximum value for all the contracts to be given below the umbrella, and all companies sitting in its shadow can bid at various specific launchs that need to be done. (In the industry, it is known as an indefinite distribution, uncertain amount (IDIQ) award.

In the specific case of NSSL3.1, the IdIQ is priced at $ 5.6 billion, which means that the rocket lab can win contracts worth $ 5.6 billion from the space force during the period from June 2024 to June 2029.

How much money will the rocket lab get?

In fact, the contracts and funds earned under NSSL3.1 will be almost certainly spread to all five companies that are placed under the umbrella – of which the rocket lab is only one. So a extremely thick estimate may be whether the rocket lab will finish 20% or the time of money on the offer – $ 1.1 billion. Spread over five years of NSSL3.1, which will be the amount for the company for an additional annual revenue of $ 220 million.

The “$ 220 million” may not be impressive as “$ 5.6 billion”. This is still more than half the amount of all revenue rocket lab in the previous year.

Who else is playing?

Other contestants for NSSL3.1 include Blue Origin, SpaceX, The United Launch Alliance (A) Boing (B. A 0.89%, And Lockheed Martin (LMT 2.46%, Joint venture), and privately held Space Company Stoke Space.

Therefore, while rocket labs, boing, and lockheed Martin are only a few space companies under this umbrella contract, they are only what retail investors can invest easily.

A factor that can work against the rocket lab in winning a specific launch, is the fact that the new glenn of Blue Origin, SpaceX’s Falcon 9, or unlike the vulcan of the United Launch Alliance, the rocket that rocket lab nSSL3.1 Contracts, will be offered in its bowls yet Is. Nor, for that case, Stoke’s “Nova” is a rocket, so Stoke is in uniform (temporary) loss.

Investors should speculate that the first task order contracts provided under NSSL3.1 will probably go to companies that already have certified and flying: Blue Origin, SpaceX and United Launch Alliance.

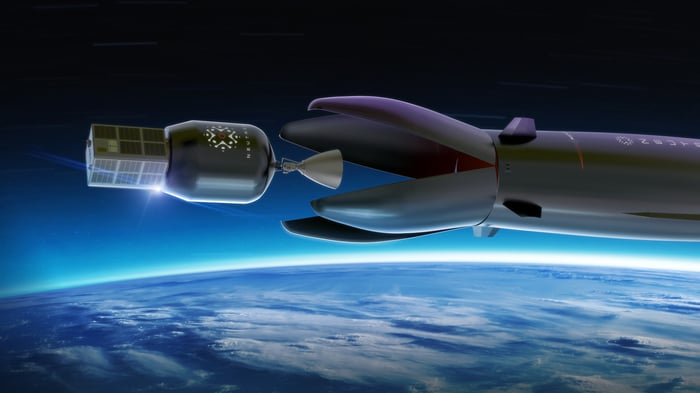

Image Source: Rocket Lab.

What’s next for rocket lab?

Whether the rocket lab can overcome its loss, and how many launch contracts of winning under NSSL3.1 will end, it will depend much more on how soon it is able to operate its inaugural neutron rocket launch. A launch plan was recently upset by almost mid-year, but if everything goes well, the rocket lab can still get its first neutron in the second half of 2025 in the orbit.

If this is successful, the company is a good chance of winning a large part of the NSSL3.1 fund over the proposal over the next few years. Also, in the opinion of Wall Street analysts, there will be a good chance of turning free-cash-flow positive earlier next year.

Rich Smith has positions in Rocket Lab USA. Motale flowers Lockheed Martin and Rocket Lab recommend the USA. The Motley Fool has a disclosure policy.